Describe Four Purposes of Cost Allocation

Lets look into these in more detail. 6 20 OVERVIEW 7 OPGs cost allocation methodology is overall consistent with that which was accepted by 8 the OEB in EB-2016-0152 EB-2013-0321 EB-2010-0008 and EB-2007-0905.

Objectives Of Cost Accounting List Of Top 15 With Explanation

The answers to these ques- tions depend on the principal purpose or purposes of the cost allocation.

. However the resulting costs are also often used by managers in planning performance evaluation and to motivate managers. To motivate managers and employees. To motivate managers and other employees 3.

Cost allocation is the process of identifying accumulating and assigning costs to specific cost objects. Schedule 4 Page 1 of 6. The four main purposes for allocating costs are to predict the economic effects of planning and control decisions to motivate managers and employees to measure the costs of inventory and cost of goods sold and to justify costs for pricing or reimbursement.

These allocations frequently service financial accounting purposes. Cost allocation means the direct distribution of the cost heads to various departments based on a reasonable factor. Costs are allocated to products and projects to measure inventory costs and cost of goods sold.

Helps evaluate and motivate staff. Costs are allocated for three main purposes. To justify costs or obtain reimbursement.

The following are some of the reasons why cost allocation is important to an organization. How is activity-based costing useful for pricing decisions. To provide information for economic decisions To decide whether to add a new airline flight 2.

Generally to assign the indirect costs to the cost objects we use the term cost allocation. Your submission should provide a clearly established and sustained viewpoint and purpose. The purpose of this cost allocation plan is to summarize in writing the methods and procedures.

COST ALLOCATION METHODOLOGY 2. Describe four steps in the cost allocation process in relation to financial analysis. Secondly can you describe some of the methods used to allocate support costs.

Lets assume that the owner Lisa. Through cost allocation indirect costs are assigned to the cost objects in proportion to the cost objects use of a. In the examples below we used the square footage and the.

To measure income and assets. Assists in the decision-making process Cost allocation provides the management with important data about cost. Explaining the purposes of cost allocation.

Example 1 Expense Amount 5000 Costs that benefit two or more specific programs but not all. To justify costs or compute reimbursement. To provide information for economic decisions.

Solution for Describe four purposes of cost allocation. Your writing should be well ordered logical and unified as well as original and. Cost allocations are sometimes made to influence management behaviour and thus promote goal congruence and managerial effort.

3 10 PURPOSE 4 The purpose of this evidence is to describe OPGs cost allocation methodology. Purpose Illustration To provide information for economic decisions To decide whether to add a new airline flig View the full answer. Describe four purposes of cost allocation.

To provide information for economic decisions 2. 1 make decisions 2 reduce waste and 3 determine pricing. What are the four steps in the cost allocation process.

The four purposes of cost allocation are indirect costs to cost objects such as products distribution channels and customers. The four purposes of cost allocation are. Cost allocation is also used in the calculation of profitability at the department or subsidiary level which in turn may be used as the basis for bonuses or the funding of additional activities.

To measure income and assets for meeting external reporting and legal regulatory obligations. Four purposes of cost allocation are as follows. When allocating costs there are four allocation methods to choose from.

The four main purposes for allocating costs are to predict the economic effects of planning and control decisions to motivate managers and employees to measure the costs of inventory and cost of goods sold and to justify costs for pricing or reimbursement. A cost object can be a specific product or product line a particular service you offer an activity associated with production or a department or division in your company. For Lisas Luscious Lemonade a cost center can be as granular as each jug of lemonade thats produced or as broad as the manufacturing plant in Houston.

Describe two alternative approaches to long-run pricing decisions. It is a type of cost apportionment which allocates a cost to a cost object A Cost Object A cost object is a method that measures product segment and customer cost separately to determine the exact. To justify costs or compute reimbursement amounts 4.

Lesson Quiz Course 18K views Cost. To obtain desired motivation. Grantee should describe methodology for applicable costs.

The cost allocation definition is best described as the process of assigning costs to the things that benefit from those costs or to cost centers. Cost allocation Purposes of cost allocation Four purposes forallocatingindirect coststo cost objects such as products distribution channels and customers. The four main purposes for allocating costs are to predict the economic effects of planning and control decisions to motivate managers and employees to measure the costs of inventory and cost of goods sold and to justify costs for pricing or reimbursement.

To motivate managers and employees To encourage the design of products that are simpler to. Allocating costs serves three main purposes. Cost allocation is used for financial reporting purposes to spread costs among departments or inventory items.

Difference Between Cost Allocation Cost Apportionment.

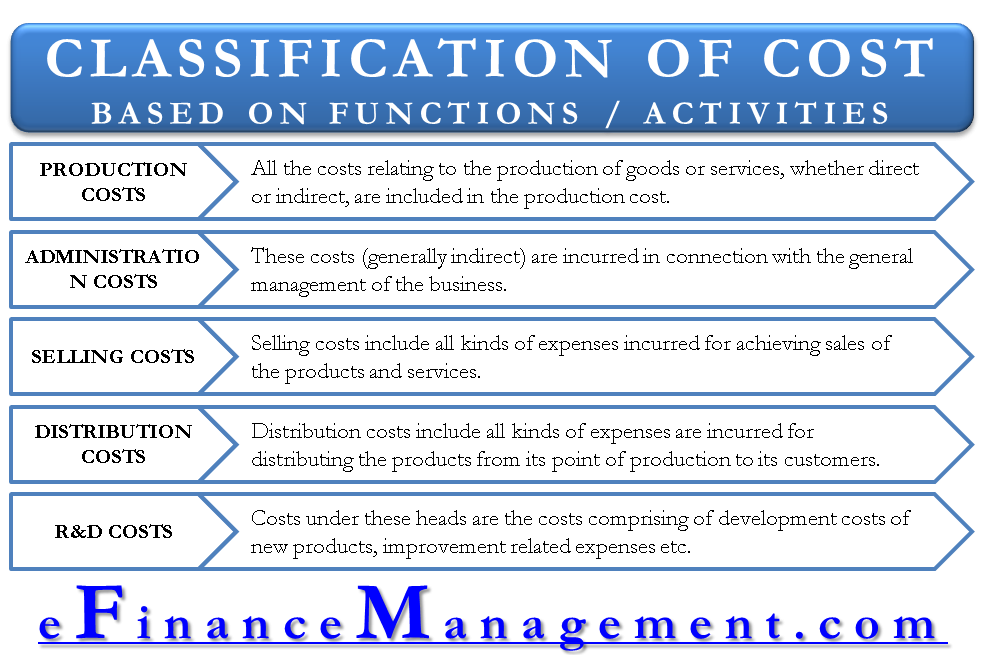

Classification Of Costs Based On Functions Activities Efm

Cost Allocation Meaning Importance Process And More Accounting Education Learn Accounting Bookkeeping Business

Belum ada Komentar untuk "Describe Four Purposes of Cost Allocation"

Posting Komentar